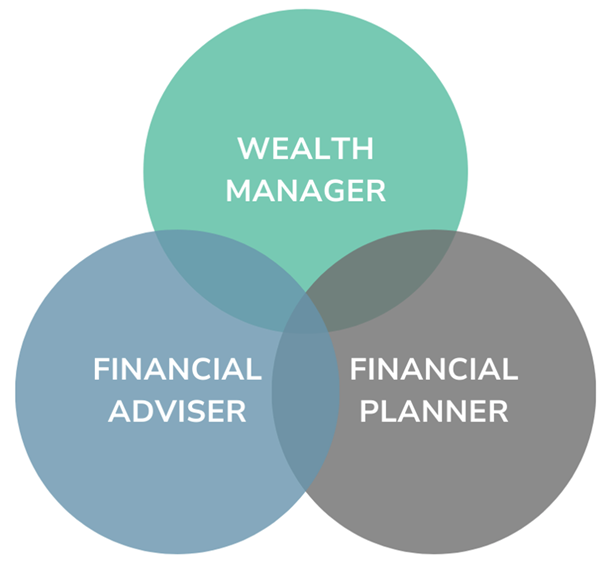

This series of posts is aimed at Financial Advisers and Financial Planners wanting to understand how and why I believe they can attract more and better clients, add more value in their preferred market niche AND enjoy a more rewarding and fulfilling career in the process of serving their clients – by training to become a Wealth Management Coach.

Which role would you choose?

If you’re a professional financial services provider, you’ll want to work in the most profitable, sustainable and fulfilling business, and you’ll want the process and outcomes to be as rewarding, fulfilling and meaningful for you and your clients as possible.

In order to bring that about proactively, you’ll need to (a) identify the market niche(s) that you want (and are best placed) to serve, and then (b) design, market and deliver a service proposition that optimises the amount of value you deliver to the optimal number of those target clients on a sustainable basis, and (c) optimise the value you derive in the process. I call it “Adding Value to Create Value”.

So, how do you choose your ideal niche market in practice?

Well, for financial services professionals who have the appropriate temperament and are prepared to acquire the appropriate skills, experience and resources, I believe a comprehensive and holistic coaching-based and Life & Legacy-focused Wealth Management Programme (incorporating the Hereditas Legacy Planning Process) is the ideal client service proposition to offer.

Choosing a Niche to serve

If you’re going to deliver a Wealth Management Programme, you need to pick one or more niche markets to focus on and serve.

For example, if you want to work with wealth creators and wealthier people for whom regulated financial products are likely to be needed to achieve the outcomes they seek, then the options are wide indeed, and include broad occupational niches (for example; Professional, Technical and Medical Service Providers, Senior Business Managers and Executives, Family Business Owner-Managers, Entrepreneurs, Successful Athletes and Entertainers etc). Or you could choose to focus on a subset of those people going through common life stages or transitions (such as Retirees, Business Sellers, Parents, Divorcees or the Bereaved). Subsets could be further refined using demographics, location, legal jurisdiction or any other delineating feature.

Why focus on delivering a wealth management programme? Because there is very little effective competition in this space, the service systematically creates and maintains long-term relationships that bring about “win-win” outcomes for all parties, and a service of this scope will address the three most legitimate strategic concerns that High (or Ultra High) Net Worth clients with more complex circumstances than average are likely to face over their lifetimes:

(a) living a fulfilling and meaningful and rewarding Life that honours their highest values.

(b) avoiding Cashflow and Liquidity shortfalls and loss of financial independence, irrespective of what life has in store for them.

(c) building an enduring Legacy over their lifetime (and beyond) that has the most positive impact on the people and causes they care most about.

The Demand for Financial Advice & Related Services

Whatever your chosen niche, according to research, the biggest issues that stimulate demand for financial advice and related services (typically as a means to a more strategic end) are:

- Retirement: around 60% of all enquiries relate to pre-retirement and post-retirement planning and management.

- Business Exit & Succession: a further 15% of all enquiries relate to the process of building and selling (or passing on) a business and living off the sale proceeds (or a share of the profits).

- Legacy, Estate & Contingency: approximately 8% of all enquiries relate to the preparation of wealth and related responsibilities for transfer to nominated beneficiaries and/or personal representatives.

- Buying a Home: about 8% of all enquiries relate to property transactions.

- All Other Enquiries: account for the remaining 9% of demand, the majority of which are also transaction-based.

In the context of choosing a client service proposition to offer, the data suggests that at least 83% of all service requirements are best suited to an open-ended wealth management process (suggesting a strategic Wealth Management Programme Director role could be the best service proposition, given that less than 17% of all service enquiries suit a one-off or short-term, project-based transactional service (which are best served by traditional transaction-focused Financial Adviser’s service proposition).

The Availability of Different Types of Financial Service Providers

In a mature financial advice market like the UK, you might expect the availability of financial service providers to be broadly proportional to the demand for the services they offer, but according to research:

- Transactional Advice Firms: There are approximately 16,098 FCA-regulated financial advice firms (of various sizes) operating in the UK offering a transaction-based advice and related service proposition, of which 64% restrict their advice and service to a specific range of financial products, with the remainder offering independent advice and related service regards a narrow to wide range of financial products, brokered from the whole market (at least in principle).

- Transactional Financial Advisers: Within those 16.098 transactional advice firms, 28,277 people are authorised to provide FCA-regulated transactional advice and related services of which 85% restrict their advice to a specific range and the remaining 15% offering independent advice and related service regards financial products sourced from the open market (at least in principle).

- Financial Planners: There are only just over 5,000 Chartered Financial Planners and just under 1,000 Certified Financial Planners in the UK.

- Family Offices It is estimated that there are less than just over 8,000 Family Office structures worldwide of which just under 1,000 are based in the UK, and that an estimated 650 FCA-registered advice firms in the UK have the capability to offer an equivalent wealth management service proposition.

The data implies that no more than 37% of all FCA-regulated financial services providers have the capability to consistently and sustainably deliver a holistic wealth management process that has a high probability of bringing about the desired outcomes for 83% of those with financial service enquires AND that only 650 firms have the capability to do so at the High to Ultra-High net worth end of the market.

The data also implies that the remaining 63% of all Financial Advisers are best suited to serving the remaining 17% of transactional enquiries, suggesting that no more than 17% of market demand would best be served by a substantively transaction-based financial adviser (and almost half of that demand would specifically be the preserve of specialist mortgage and insurance brokers). The conclusion is that 83% of Financial Advisers would best serve the market by becoming Financial Planners (as a minimum) and in the case of clients and groups of clients with more complex circumstances and histories and circumstances, Wealth Managers. Yet only around 19% of all Financial Advisers have Chartered status, meaning the vast majority of clients are likely being serviced by advisers and organisations that are only able to provide a partial or sub-optimal service, give the clients most strategic objectives.

Defining your Wealth Management Service Propositions

Any comprehensive Wealth Management Programme that seeks to optimise the value it delivers to your market niche is going to have to effectively address the following “big four” agenda items:

- Life Planning: creating and/or managing wealth in all its forms in alignment with values to so that appropriate resources are available as needed to optimise their lifestyle without the risk of running out of money in their lifetime.

- Contingency Planning: protecting and preserving personal and financial independence, dignity and security in the event of a poor health or premature death scenario.

- Estate Planning: planning and managing the effective and tax-efficient transfer of wealth (in all its forms) and associated powers and responsibilities to beneficiaries and personal representatives on death or mental incapacity.

- Legacy Planning: ensuing that beneficiaries and personal representatives are appropriately prepared to optimise the benefits derived from the wealth (and/or related powers and responsibilities) they inherit.

The skills, tools and processes required to do so were discussed in my previous posts.

Key Demographics in favour of offering a Wealth Management Programme

Here’s why your future clients are going to need you:

- Rising Net Worth: Household net worth in the UK increased from £2.8tn to £10.2tn between 1995 and 2015, suggesting we will see a continuing rise in the ongoing value of wealth transfers.

- Wealth Transfer: Between 2017 and 2047, £5.5 trillion will transfer between the generations in the UK, predominantly from those currently over 50.

- Millennial Beneficiaries: People currently aged 30-45 (known for valuing choice, transparency, and ethics) will be the primary beneficiaries of this wealth transfer.

- Lack of Preparation: Many benefactors (57%) plan to pass on all their wealth upon death or illness, yet the majority of beneficiaries are unprepared for this inheritance.

- Wealth Dissipation Risk: Studies indicate that 90% of all inherited wealth is lost by the third generation due to lack of preparation and poor communication.

- Communication Gap: Only 10% of people seek professional advice regards their legacy, estate and contingency planning in their lifetime.

- Adviser Disconnect: 47% of all intended beneficiaries expect to use their benefactor’s advisers, but 59% of those advisers lack a succession plan.

- Emotional Impact: Sudden wealth can have negative effects, with concerns about drug abuse, poor money management, and misalignment of values.

- Non-Financial Legacies: Passing on values and life lessons is considered at least as important as preparing for the transfer of financial assets in the process of protecting family wealth for future generations, emphasising the need for holistic legacy planning to prepare beneficiaries and personal representatives.

- Positive & Meaningful Legacy Planning: Effective legacy planning needs to combine financial, emotional, and values-based components to ensure wealth preservation and transfer has a positive and meaningful impact on the beneficiaries.

The Problem

The demand for wealth management services (particularly Wealth Management Programmes) to address the issues faced by High to Ultra-High Net Worth clients is likely to continue to soar and the already limited availability of experienced firms providing suitable service propositions is going to fall under ever increasing strain, meaning there is the equivalent of an “advice gap”.

Against that backdrop

Given the supply and demand figures, no less than 8% and no more than 17% of all financial services providers should be providing a predominantly transaction-based services (i.e. specialist and hybrid Financial Advisers), and around half of all their transactional services should be substantively focussed on the needs of the home-buying market.

Now, Buying a Home is essentially a “SMART” objective (i.e. it is limited in its scope, it’s project-based and it’s timebound) whilst the objectives around Career & Retirement planning, Business Development & Exit planning and Legacy, Contingency & Estate planning tend to be necessarily require an on-going process-based solution (i.e. ongoing support for the process of optimising a clients lifestyle and legacy over a lifetime and beyond in accordance with their highest values and related goals and priorities).

This also implies that the demand for the services that Lifestyle Financial Planners and Wealth Management Programme Directors are best placed to provide should mean that 83% of all financial services professionals should be specialists in this area, and yet only 20% of all FCA-regulated Financial Advisers are Chartered Financial Planners potentially experienced and capable enough to providing a robust Lifestyle Financial Planning or Wealth Management Programme service (and in my experience, many Chartered Financial Planners have less than optimal tools, skills, processes and systems to genuinely provide these services to a consistently high standard).

The Mission

If over 83% of all financial advice enquiries are suited to a holistic and process-based wealth management solution as the above data suggests, it suggests that less than 17% of all potential client enquiries received by Financial Advisers and Financial Planners would be best served by a one-off advice or an occasional project-based product or transaction-based solution, implying that a well-designed and delivered Wealth Management Programme provided on commercially attractive terms would be the best and most value-adding solution to clients and financial services providers alike. And yet over 80% the all providers of financial advice are either transaction-based Financial Advisers or hybrid advisers offering product-focused transactional advice backed by a product and transaction-focused financial planning service.

The Opportunity

If the vast majority of all financial advice enquiries are best served by a wealth management-based service solution designed to bring about a process-driven goal rather (than a project-based or time-bound SMART goal) and if (by extension) the desired outcomes of the majority of potential clients require a significant element of holistic financial planning and an effective wealth management and review process in order to optimise the probability of a “better than average” (or “Wouldn’t-It-Be-Amazing-IF”!) outcome, but only 20% of advice providers are even remotely prepared and ready to provide the necessary services, then there is clearly a supply-side shortage issue.

A typical Lifestyle Financial Planning objective is “I don’t want to run out of money in my lifetime”. This is a classic example of service requirement (rather than one-off SMART-Goals) needing a process-driven rather than project-based solution. Building a career or business, living off earnings, accumulating wealth and then living off the wealth and profits throughout retirement is an ongoing process not a one-off project. With only 8% of advice enquiries being driven by a project-based goal (and in our world, legacy planning and management is a process-goal not a SMART-Goal – albeit, Estate Planning could perhaps be more defined as a SMART Goal) then we need more value-adding process-based wealth managers and hybrid lifestyle financial planners.

Our Business Development Solution

The Wealth Manager Academy from the Wealth for Life Partnership is the only Training & Business Development resource in the UK that is dedicated to training and developing the next generation of Wealth Management Programme Directors to deliver a Wealth Management Programme that puts values-driven Lifestyle and Legacy focus at the front and centre of the financial planning and wealth management process for a forward-looking family with the modern-day challenges and opportunities that multiple generations of connected and related individuals with complex needs inevitably bring.

The Wealth Manager Academy runs Business Development Programmes for any specialist or hybrid Financial Advisers and Financial Planners keen to develop their business and add more value to more valuable clients by transitioning into Wealth Managers (essentially by helping them connect with their target market more effectively, building better quality relationships with benefactors, contributors and beneficiaries – and then increasing the value their core service proposition delivers to their ideal client profile; creating more fulfilment and value for themselves in the process).

A cost-effective and value-adding Wealth Management Programme could easily be added to the client service proposition of a typical Lifestyle Financial Planner with 12 months of focused business development and training.

Expanding a practice to deliver a more comprehensive Wealth Management Programme agenda for wealthier and more complex multi-generational groups of related or otherwise connected individuals may take a couple more years to put in place, but is definitely achievable in 3 years.

Conclusion

There is clearly a gap in the market for Wealth Management Programmes provided by a Wealth Management Programme director under a hybrid client service model that encompasses the expertise of well-trained, suitably experienced and motivated Financial Advisers, Financial Planners and Wealth Managers.

The Wealth Manager Academy has been established to train and develop current and future generations of Financial Advisers and Financial Planners and grow the availability of these high-value service providers in the UK to meet the clear and obvious demand.

The obvious demand is why training as a Hereditas-accredited Wealth Management Coach and delivering a Wealth Management Programme with a Life & Legacy agenda could be the best career path for Financial Advisers and Financial Planners with the right values and personality type, helping them add more value in their market niche and enjoy a more rewarding and fulfilling career in the process.

The Wealth Manager Academy

Hi, I’m Mark Pritchard-Jeffs, a highly skilled Wealth Management & Business Development Coach with over 35 years’ financial services experience, including over 17 years as an IFA and 15 years as a Partner of St. James’s Place. Together with my business partner, Andrew Dodson (who has even more years of experience than I do), we founded the Wealth Manager Academy.

The Mission

The Wealth Manager Academy is dedicated to training and developing the next generation of Wealth Management Coaches and Wealth Management Programme Directors. We’re looking for up-and-coming Financial Advisers and Financial Planners who are keen to offer more value to their clients. We can show you how to design, market and deliver a values-led, coaching-based and relationship-driven wealth management process, which follows a comprehensive Life & Legacy agenda that systematically attracts and retains higher-net-worth clients, improves client outcomes, delivers greater client satisfaction, promotes greater advocacy, builds enduring job satisfaction and generates higher earnings in the process. If that sounds of interest, read on!

The Vision

The Wealth Manager Academy runs specialist Business Development Programmes designed to embed value-adding wealth management skills, tools, processes and systems into the businesses of the clients we work with. You’ll complete an initial foundation course to prepare you and your business to deliver a Wealth Management Programme and to promote yourself as a professional Wealth Management Programme Director. You’ll then follow a course of self-study, supplemented by group workshops and personal 1-2-1 coaching and mentoring sessions to help you transition from “wherever you are now” into a fully accredited Wealth Management Coach, confident in your ability to market and deliver a fee or subscription-based wealth management programme that attracts and retains higher-quality clients, generates stronger demand for FCA-regulated financial services and creates more enduring value and fulfilment for you and your business in the process.